Post By

Banking CRM

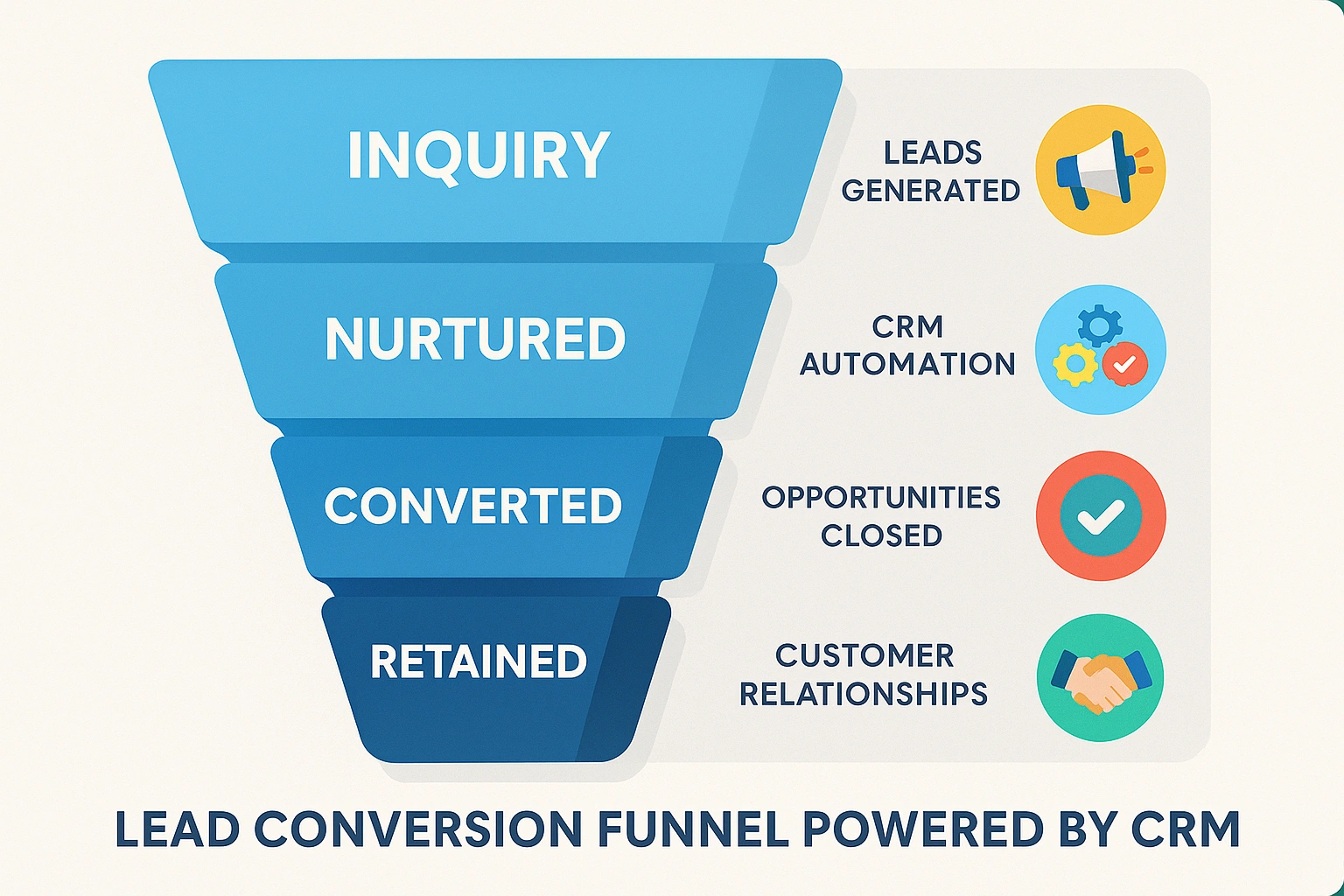

By 2025, customer relationship management (CRM) will be more than a support tool—it will be the driving force of modern private banking. Relationship intelligence now matters as much as financial management, with clients demanding seamless digital experiences, real-time service, and personalized offerings. The question facing financial leaders is simple: is your bank truly ready for CRM in 2025? At Scaloy, we help financial institutions reimagine client engagement with CRM platforms tailored for banking workflows. From creating a 360° view of each customer to implementing AI-driven predictive analytics, Scaloy empowers banks to strengthen client loyalty, boost efficiency, and embrace the next stage of digital evolution. This blog explores emerging CRM trends, challenges, benefits, and best practices that every banker should know. In banking, customer-first strategy is the new currency of growth. A CRM provides banks with a 360° view of clients, integrating demographic data, transactions, interactions, and behavioral insights into one unified profile. This ensures personalized service, reduced friction, and real-time responsiveness. For example, in a healthcare project supported by Scaloy, a unified dashboard reduced patient waiting times by 45% and cut missed appointments by 30%. In banking, the same CRM approach empowers relationship managers, service representatives, and AI assistants to deliver contextualized, consistent support that strengthens trust. While CRM adoption offers tremendous potential, banks often face challenges unique to financial services. Scaloy addresses these challenges through industry-focused solutions: By solving these challenges, banks transform CRM into a strategic enabler of growth, compliance, and customer experience. Implementing CRM platforms designed for banking unlocks measurable benefits: For banks preparing to leverage CRM effectively, Scaloy recommends the following best practices: Scaloy has driven CRM success across industries that directly translate into banking advantages: In banking, similar solutions accelerate approval times, improve advisor productivity, and deliver mobile-first customer engagement. By 2025, CRM will define the future of private and retail banking. It is no longer an option but a necessity for banks seeking clarity, control, and client-centric growth. From AI-powered predictive analytics to compliance-ready workflows, CRM enables banks to transform relationships into long-term value. The question is not whether to adopt CRM, but how quickly your bank can act to remain competitive in this digital-first era.

The Importance of CRM in Banking

Challenges and Solutions in CRM for Financial Services

Key Benefits of CRM in Banking

Best Practices for CRM-Ready Banks

Case Studies and Real-World Examples

Implementation Process

Conclusion

What is CRM in banking and why is it important?

CRM in banking refers to platforms designed to manage client relationships by unifying customer data, transactions, and interactions. It improves personalization, efficiency, compliance, and long-term client loyalty, making it essential in 2025.

How does a 360° customer view benefit banks?

A 360° view combines customer demographics, transactions, and engagement history into a single profile. This enables better decision-making, tailored financial products, and more consistent customer experiences.

What role does mobile banking play in CRM?

Mobile banking applications integrate with CRM to provide real-time access for both clients and advisors. Customers benefit from instant communication, on-the-go transactions, and personalized recommendations powered by CRM insights.

How does automation improve banking CRM workflows?

Automation streamlines approval systems, compliance checks, and onboarding processes. It reduces delays, improves efficiency, and allows relationship managers to focus on value-added client engagement.

What are the best practices for implementing CRM in financial institutions?

Banks should invest in financial-grade CRM systems, integrate mobile-first strategies, adopt predictive analytics, align KPIs with goals, and embed compliance frameworks into every workflow.

How does AI enhance CRM for banking?

AI enables CRM to forecast customer behavior, recommend products, detect early churn risks, and personalize interactions at scale. This creates smarter and more profitable client relationships.

What compliance factors should banks consider in CRM?

Banks must ensure CRMs comply with RBI, PCI DSS, GDPR, and regional data privacy rules. Secure storage, audit trails, encryption, and access controls are non-negotiable features in financial CRMs.

Can CRM improve cross-selling and upselling in banking?

Yes. By analyzing transaction histories and customer behavior, CRM identifies opportunities for targeted cross-selling and upselling, increasing revenue and deepening client relationships.

How secure is CRM data in financial services?

Modern banking CRMs use multi-layer security, including encryption, multi-factor authentication, and role-based access controls. Scaloy also designs compliance-ready workflows to meet strict regulatory requirements.

What is the future of CRM in private banking?

The future of CRM in private banking is AI-driven, mobile-first, and compliance-ready. Banks that adopt these systems will offer personalized, proactive, and seamless customer experiences, securing long-term loyalty.

Discover our other blogs.

Automated QC

Speed, accuracy, and efficiency are critical in the rapidly evolving field of diagnostics and...

Yash Patel

Jul 10, 2025

Scaloy Success Stories

In today’s dynamic corporate environment, embracing the right technology is no longer o...

Ankit Patel

Jun 20, 2025

Scalability

In the ever-accelerating digital era, where speed, resilience, and adaptability are more than...

Vasu Patel

Jun 1, 2025

RPA

In today’s fast-paced business world, speed, precision, and innovation define success. ...

Isabella Rossi

May 10, 2025

IOT Takeover

Imagine receiving care, diagnosis, and monitoring from a network of intelligent medical devic...

Ishita Choudhury

Apr 23, 2025

IOT In Healthcare

The healthcare industry is undergoing a paradigm shift. Rising demands, growing costs, and th...

Noah Fischer

Apr 6, 2025

IOT

In today’s digital-first economy, businesses are under increasing pressure to process m...

Emma Williams

Mar 20, 2025

Digital Transformation

In an era of accelerating change, digital transformation is no longer a choice but a necessit...

Siddharth Nair

Mar 3, 2025

Data Driven Strategies

In today’s hypercompetitive digital economy, data has become more than just information...

Liam Johnson

Feb 17, 2025

Cloud Native Healthcare

The healthcare industry is experiencing rapid digital acceleration. From electronic health re...

Kavya Iyer

Jan 31, 2025